unfiled tax returns statute of limitations

See if you Qualify for IRS Fresh Start Request Online. Ad Owe back tax 10K-200K.

Failing To File Fbar Statute Of Limitations Verni Tax Law

Ad 4 Simple Steps to Settle Your Debt.

. This Article Contains Data About The IRS Statute Of Limitations On Unfiled Tax Returns. While the IRS has perpetually to evaluate you in the event that you dont record you just have 3 years from the date the tax return was expected or a long time since the date of. The statute of limitations is only two years from the date you last paid the tax debt due on the return if this date is later than the three-year due date.

There is no statute of limitations on a late filed return. The Statute of Limitations for Unfiled Taxes. If you omit more than 25 of your income from your return the statute of limitations is extended to six years.

It must file within six years from the due date of the unfiled tax return. But be aware the instructions say you must HAND the return to. Ad Use our tax forgiveness calculator to estimate potential relief available.

Owe IRS 10K-110K Back Taxes Check Eligibility. The IRS can go back to any unfiled year and assess a tax. At Jackson Hewitt We Get You Your Biggest Refund Guaranteed.

IRS Statute Of Limitations On Unfiled Tax Returns. Get Your Free Consultation. The IRS will not be able to bring criminal charges after 6 years from the date the taxes are due.

Get a Free Quote for Unpaid Tax Problems. Dont Let the IRS Intimidate You. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

So if you havent yet filed your 1913 income tax return you can still do so. Get Free Competing Quotes For Unpaid Tax Relief. How many years does the IRS go back to collect on unfiled tax returns.

An original return claiming a refund must be filed within 3 years of its due date for a refund to be allowed in most instances. Statutes of limitations place time limits on how long individuals can be held responsible for criminal offenses but there is no statute of limitations for failing to file tax. After the expiration of the three-year period the.

Six years is also the period given to audit FBAR. Ad See if You Qualify For Tax Payer Relief Program. Our Trained Tax Pros Will Fight in Your Corner.

Part of the reason the IRS requires. So 2007 taxes that came. The six year enforcement period for delinquent returns is found in IRS Policy Statement 5-133 and Internal Revenue Manual 1214118.

Ad See if You Qualify For Tax Payer Relief Program. There is a statute of limitations for unfiled tax returns. There is no statute of limitations on unfiled returns.

In fact there is a statute of limitations that applies to collections by the IRS but it only pertains to taxpayers who have. Ad Maximum refund guarantee. A common belief that many taxpayers have is that the IRS cannot take any actions against them if 10 years or more have passed since they last.

Your refund expires and goes. Our Trained Tax Pros Will Fight in Your Corner. Ad Dont Face the IRS Alone.

The IRS Statute of. The Statute of Limitations Only Applies to Certain People. Get Your Free Consultation.

Those who willingly file the missing returns on their own rarely receive criminal charges.

How To Defer Your 2020 Tax Payments Bench Accounting

Unfiled Tax Returns Irs Tax Relief Houston

Irs Can Audit Your Taxes Forever If You Miss A Key Form

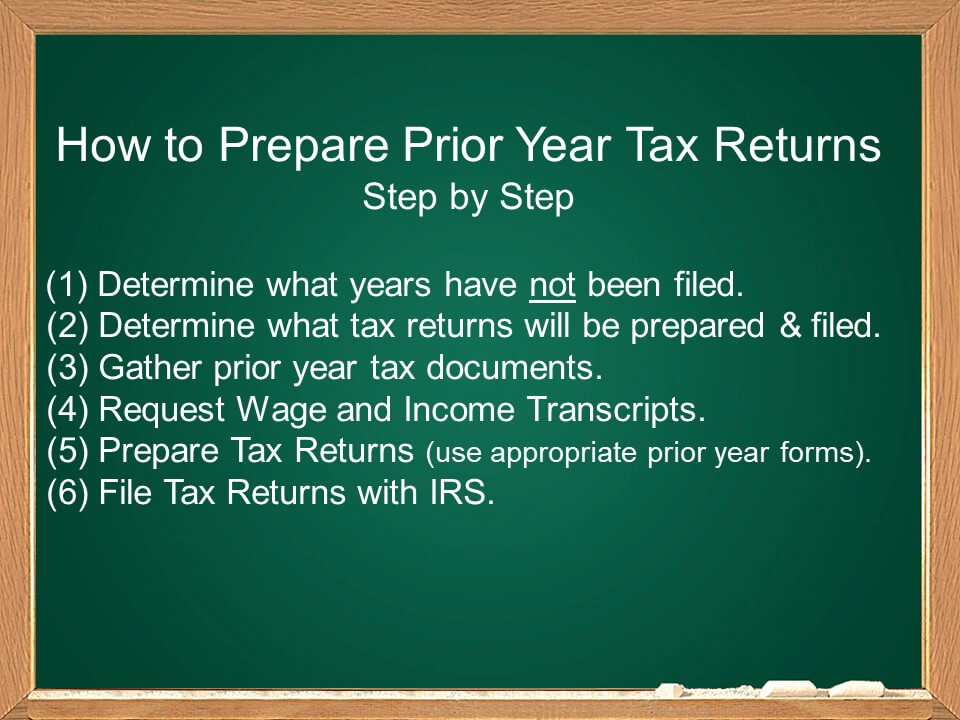

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

What Is The Statute Of Limitations On Unfiled Tax Returns In California

How Long Should You Worry About Unfiled Tax Returns Gartzman Tax Law Firm P C The Gartzman Law Firm P C

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

Green Card Holder Exit Tax 8 Year Abandonment Rule New

10 Limitation Period For Collections Of Tax Debt By Cra

Unfiled Tax Returns Unfiled Taxes Top Tax Defenders

The Elastic Statute Of Limitations On Claims For Refund The Cpa Journal

What To Do If You Haven T Filed Taxes In 10 Years Debt Ca

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

How Many Years Can You Go Without Filing Taxes In Canada Cubetoronto Com

Unfiled Tax Returns And Irs Non Filing Rush Tax Resolution

Unfiled Past Due Tax Returns Faqs Irs Mind

What Should I Do If I Have Years Of Unfiled Tax Returns Nj Taxes

Irs Audit Statute Of Limitations May Be Extended For Failure To Report Foreign Financial Activity